Solutions For

-

Asset Managers

- Take advantage of the most accurate machine learning derived ESG data set to further your market understanding with independent ESG insights.

-

Quantitative Fund Managers

- Beat the market using our timely Machine Learning ESG data set to understand the real drivers of performance and volatility.

-

Asset Owners

- Oversee asset managers with increased transparency using state-of-the-art machine learning driven independent ESG insights.

-

Fixed Income Managers

- Analyze the market with a powerful machine learning driven ESG data set to gain a timely independent perspective.

-

Index Providers

- Leverage the most accurate machine learning ESG data set as you build and maintain your indices.

-

Investment Advisors

- Customize your service based on client’s unique values with independent machine learning driven ESG scores.

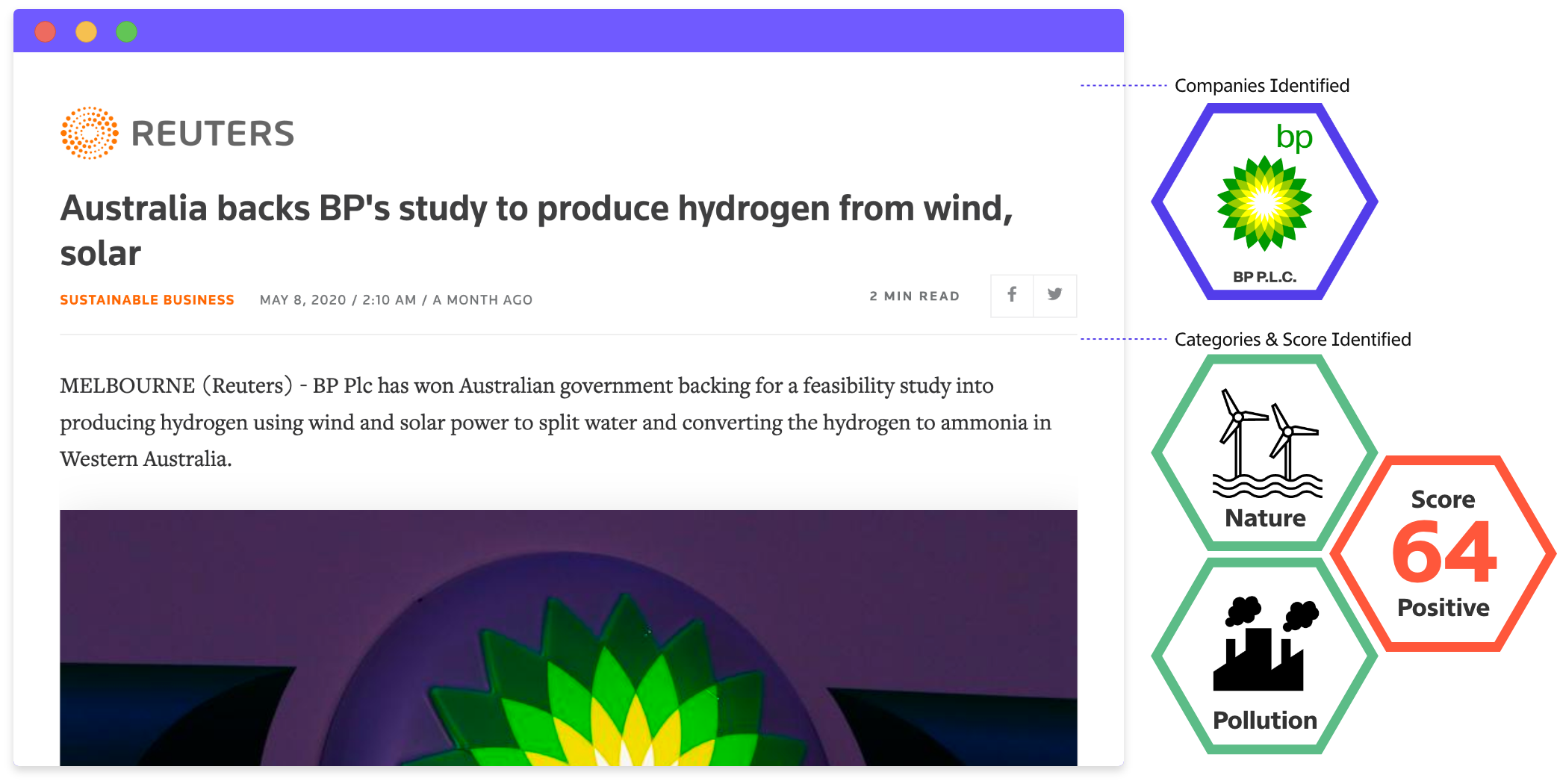

Our algorithms identify predictive ESG signals in the news

Natural language processing highlights the companies in current news articles, identifies sub-narratives, and analyzes grammar, topics, and sentiment.

-

Act Fast Score™

- The Act Fast Score™ is a real-time score to give insight into market-moving ESG changes.

-

Act Score™

- The Act Score™ provides an independent rating, supported with underlying data, for longer term investors as transparent market intelligence to counter potential greenwashing.

-

Act Volume Score™

- The Act Volume Score™ provides unique intelligence into the volume of articles, filterable by ESG issue, to establish a comprehensive picture in developing your strategies for alpha.

-

Act Daily Score™

- The Act Daily Score™ helps investors in real time to monitor and predict market changes in your search for alpha.

-

Act Momentum Score™

- The Act Momentum Score™ is a powerful tool to help predict market change using real-time news updates.

-

Act Event Score™

- Act Event Score™ helps users understand the major events, both positive developments and negative controversies for ease of consumption.

We make it easy for you to leverage our data

We’re flexible, with two ways to access our proven ESG insights. Build your own custom scores, models and tools leveraging our real-time API of the comprehensive data set, or use Act Explorer, our powerful web-based application, to discover independent investment intelligence.

import requests resp = requests.get( "https://www.act-analytics.com/" + "news-api/company-data" + "?permids=4295905494,5037473967" + "&esg-categories=labor" + "&api-key=133713371337") data = resp.json() articles = data["4295905494"] print(articles)

Announcement

October 14, 2021, Toronto - Sustainalytics, a Morningstar company and leading global provider of ESG research, ratings, and data, today announced that it is further investing in its digital innovation and enhancing its real-time ESG data analytics capabilities through an agreement with Toronto-based Act Analytics, whereby the Act Analytics team of talented portfolio management, machine learning and market data experts will join Sustainalytics.

Tel +1 647 200 6482

Contact us